For the sixth year in a row, the School of Accountancy at Georgia Southern University and the IRS have partnered to bring the Volunteer Income Tax Assistance Program (VITA) to the local community.

This is an annual partnership to provide free individual income tax preparation and e-file services to taxpayers. All tax returns are prepared and reviewed by accounting students and faculty who are IRS VITA certified.

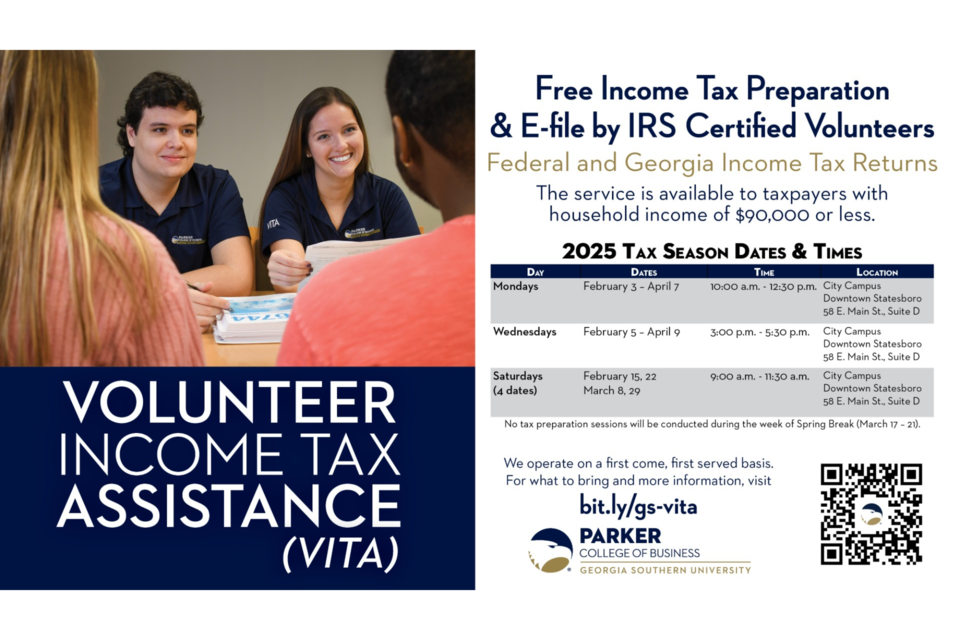

The service is generally available to taxpayers with a household income of $90,000 or less.

Free tax preparation services will begin Monday, February 3, 2025. They do not take appointments. The service is provided first-come, first-served.

Please visit the program website here for a checklist of required items to bring, the location, and dates/times.

If you have additional questions after reviewing the site, please contact [email protected].