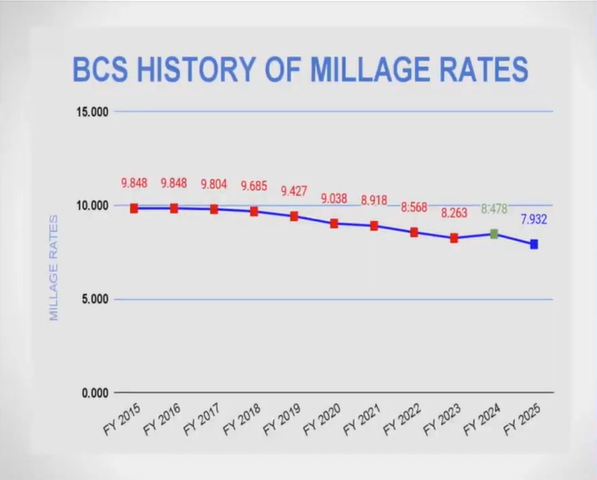

The Bulloch County Board of Education is going through its annual process of setting the school district’s maintenance and operations (M & O) millage rate. While the district’s proposed 2024 rate is lower than last year’s, is its lowest in more than 20 years, and one of the 10 lowest of Georgia’s 180 school districts, it is still considered a tax increase. The community was invited by the BOE to public hearings on Aug. 15 to learn more A final public hearing is scheduled for Aug. 22, 2024 at 9am.

At the August 15 public hearings, the Bulloch County Board of Education (BOE) shed light on the millage rate changes and what they mean for local taxpayers. If you missed the livestream, here's a rundown of the key points.

Chief Financial Officer Alison Boatright kicked things off with an explanation of how the millage rate works, breaking it down with examples for both homestead and non-homestead properties based on the average property value in our area.

This is the lowest millage rate we've seen in 11 years. However, if BCS were to roll back the millage rate completely, they’d risk losing $9.8 million in Equalization Funds from the state because the state requires a millage rate of 14 to qualify for these funds. Instead of a full rollback, the board is looking for a partial one.

This brings us to the notice of tax increase that’s been stirring up some confusion. While it may seem like your taxes are going up, in reality, most people will actually pay less in school taxes than they have been. It is more than the rollback rate, but it's still less than what we’re currently paying—and less than we've paid in the past 11 years.

The 14-mill requirement is a state mandate, but Bulloch County has a bit of an advantage here. This includes funding from Special Purpose Local Option Sales Tax (SPLOST) and other sources that help us meet that millage rate without leaning too heavily on property taxes.

Public Comments & Discussion of House Bill 581

Lannie Lanier, a newly elected board member for District 1, addressed the board with concerns about the proposed budget and the state-mandated 14-mill tax rate. He mentioned being frequently confronted by community members about the issue and shared that while it's easy to criticize the Board of Education, the real problem lies with the state law.

Lanier emphasized that efforts should be focused on changing this law, urging local legislators to prioritize it. He expressed concerns about the potential for the millage rate to increase further in the future and the pressure it puts on the board to raise taxes even when unnecessary. Lanier also pointed out that development in the area is driving up assessed values and school enrollments, which could lead to higher taxes. He called for better communication and cooperation between the board, the city, and the county to manage development and its impact on the community's finances.

Superintendent Charles Wilson responded to Lanier by acknowledging and expanding on his points. He highlighted the importance of understanding the tax base, noting that residential development typically drains resources ("takers"), while industrial and commercial properties contribute revenue ("givers"). Wilson emphasized that an imbalance, with too much residential development, could financially strain the community.

He also discussed the potential impact of House Bill 581, which will be up for a referendum in November. If passed, it would allow boards of education to cap property revaluations for primary residences based on an inflation index, offering protection to homeowners from sharp tax increases.

The Georgia House bill, which was introduced by Lt. Gov. Burt Jones as the "Save Our Homes Act,” passed the Senate in March of this year. According to Jones, "HB 581 limits increases in property taxes year to year, reforms the appeals process, and allows for more transparency in our taxation procedures."

In addition, the passage of Amendment 1022 in November would authorize the General Assembly to provide by general law for a state-wide homestead exemption that serves to limit increases in the assessed value of homesteads, but which any county, consolidated government, municipality, or local school system may opt out of upon the completion of certain procedures.

Wilson pointed out that while this might help individual homeowners, it could complicate broader economic dynamics, such as property sales and revaluations. The board will need to decide between January 1 and March 1 whether to opt into this new regulation or maintain the current system. He suggested that this development is worth keeping an eye on as the community grows and changes.

Cassandra Mikell responded by addressing Lanier's points, sharing that the Board had previously approached legislators Lehman Franklin and Billy Hickman to push for a reduction in the 14-mill tax rate to 10 mills. However, the effort failed because other areas in the state, which don’t share Bulloch County’s financial setup, didn't support the change.

She then criticized a claim made by Ms. Boatright regarding the millage rate chart, calling it misleading. Mikell argued that while the millage rate appears lower, this is due to Georgia law requiring a rollback to ensure citizens pay the same amount in taxes as the previous year. She explained that even though the millage rate might be reduced, taxpayers could still end up paying more if the rate isn’t fully rolled back. Mikell emphasized that the notice of a tax increase is not misleading, as it reflects the potential for higher taxes if the rollback doesn’t occur.

Mikell pointed out what she thinks is a potential compliance issue, noting that the required tax hearing for the following week was not advertised in the day's paper. She suggested that the hearing should be canceled as a result. Feeling like there wasn't enough time to speak, Mikell said she feels that 3 minutes to speak is not enough time to get any point across.

The board took this into consideration, and told Mikell she could have more time at next week's meeting.

The board took time to thank everyone in attendance for coming and the citizens for addressing their concerns.

The full livestream of the meeting can be viewed here.

Board of Education Meeting

AGENDA

The Board requests all cell phones be silenced.

A. Call to Order

B. Moment of Silence/Pledge of Allegiance

C. Amend/Adopt the Agenda: APPROVED

D. Consent Agenda: APPROVED

1. Board Minutes

2. Financial Report

3. Board Member Payroll for July 2024

E. Personnel Recommendations: APPROVED

F. Adjournment

The next and final public hearing will be held Thursday, August 22, 2024, at 9am at the Bulloch County Board of Education, 150 Williams Rd., Statesboro GA.