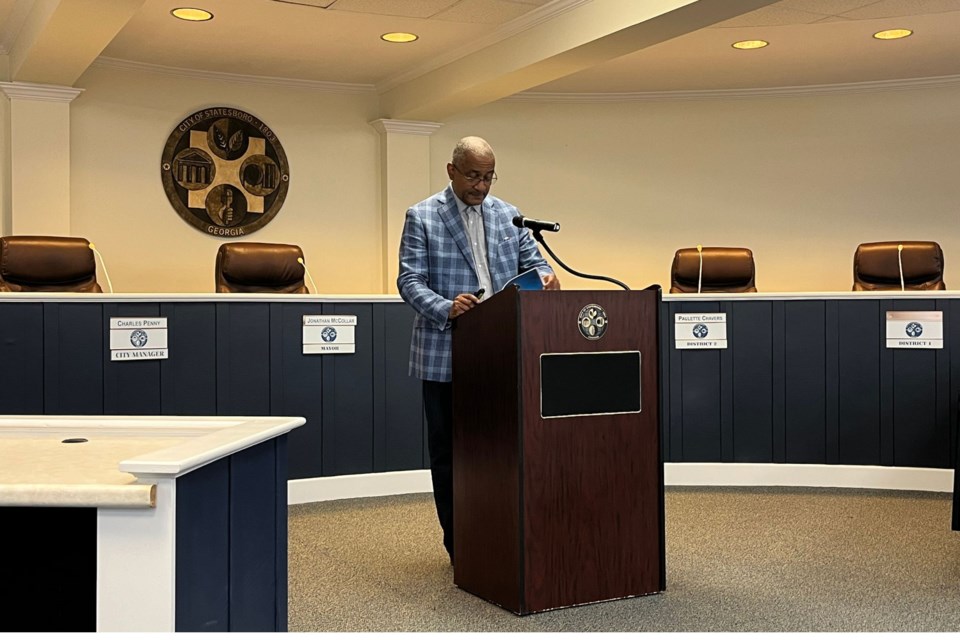

The City of Statesboro held two of the three required public hearings on the 2024 tax millage rate increase on Tuesday, September 10, 2024. City Manager Charles Penny led the two hearings in the absence of some council members, explaining that while the mayor and council were not required to attend the hearings, the law mandates three public forums to give citizens an opportunity to voice concerns.

The proposed increase would raise the millage rate from 8.125 to 9.125. The rollback rate to remain revenue-neutral would have been 7.326 mills, which Penny explained would not generate sufficient revenue to fund the city's fiscal year (FY) 2025 budget.

The increase is intended to cover various expenditures, including a newly implemented employee pay plan and the need to maintain essential services, such as police and fire departments.

Key Points of the Proposal:

- Employee Pay Plan: In January 2024, the city adopted a new pay plan, costing $2.3 million. This plan raised the starting salary for police officers from $46,000 to $55,000, and currently, there are seven vacancies in the department, down from 18. Additionally, the city has been able to avoid increasing health insurance premiums for employees.

- Public Safety: The budget prioritizes staffing in public safety departments. Penny reported that the police department budget for FY 2025 is over $11.2 million, while property tax revenue is projected to generate $10 million. Statesboro has also added new firefighters in recent years, with a total of 25 additional positions, including 12 funded by a federal SAFER grant.

- Impact on Homeowners: For a $200,000 home, the proposed millage rate increase would raise the annual property tax bill by approximately $140, from $571.43 to $711.75.

Penny highlighted that about 25% of the property in Statesboro is tax-exempt, including public buildings, churches, and hospitals, which still require city services. Additionally, while the city has experienced growth, its tax base remains smaller than Bulloch County’s, meaning it generates less revenue per mill.

CLICK HERE to view Mr. Penny's full presentation.

During the hearings, four citizens voiced concerns about the size of the tax increase and questioned whether other revenue sources could be considered. Penny acknowledged the challenges but stated that city governments are limited in how they can raise revenue. He noted that the city is already using some of its fund balance to help balance the budget, and further reliance on it could deplete emergency reserves.

“We have to ensure that we can continue to pay our employees and provide services,” Penny said. “The proposed increase is necessary to balance the budget without making cuts to services or employees.”

The final public hearing will be held during the bi-monthly City Council meeting on Tuesday, September 17 at 5:30 PM. Statesboro City Council will vote on the proposed millage rate increase during the meeting. Citizens are encouraged to attend and voice any additional concerns before the final decision is made.