The Bulloch County Board of Education tentatively approved the adoption of the 2024 Tax Digest and M&O Millage Rate for FY25, at 7.932 mills. This is a decrease from last year's millage rate of 8.478, but an increase of .374 mill over the rollback rate set this year.

This increase is necessary to maintain the 14-mill requirement that secures the school's equalization funding.

Public hearings about the tentatively approved millage rate will be held on the following days:

- Thursday, August 8, 2024 at 9:00 am

- Thursday, August 15, 2024 at 11:30 am

- Thursday, August 15, 2024 at 6:00 pm

Educators and staff of the Development Authority of Bulloch County also recapped the recent ‘Korea Corner’ trip funded by the CEO of AJIN Georgia, where they learned about the culture and educational systems of South Korea in order to prepare high school students to enter the expanding job market of Korean-owned businesses coming to the area, as well as be able to provide centralized resources for some of the Korean families with students that are moving to Bulloch county.

Continue reading for more details about the July 25, 2024 Board of Education work session.

Chair Elizabeth Williams called the July 25, 2024 Bulloch County Board of Education work session meeting to order at 6:30 pm, and board member Maurice Hill led the moment of silence and Pledge of Allegiance.

The agenda was adopted with an amendment, the addition of item three to the work session to discuss updates to the Southeast Bulloch water and sewage business.

IV. Work Session

1. Update on Korea Corner Trip

Bethany Gilliam (CTAE Director), Rob Lindsay (Nevils Elementary School Principal) and Rachel Barnwell (Vice President, Development Authority of Bulloch County) recounted the recent ‘Korea Corner’ trip from June 2-13, 2024.

Click here to view their presentation.

AJIN Georgia’s CEO 'graciously sponsored’ the Korea Corner trip, which allowed educators and members of the development authority to experience immersion into Korean culture with the goals of learning how to benefit incoming students coming from a country with different cultural values, education systems, and work-life.

The company has made a three year commitment to Korea Corner, and there will be opportunities for more educators from Bulloch, Evans, and Candler County to participate.

Gilliam says that increasing the school system's capacity to prepare Bulloch County high school students to enter the workforce was the biggest goal of the trip. The influx of Korean businesses will result in more than 1,200 new jobs in the coming years according to Benjy Thompson, CEO of the Development Authority of Bulloch County.

The trip also served the purpose of understanding culture differences, as a means to support the few Korean families that will be moving to Bulloch County.

The approach to concentrating the resources that the educators think will be important to these students’ success is the launching of what they have dubbed the ‘Korean Hub,’ which will allow these new families to register their kids in Nevils Elementary, Southeast Bulloch Middle, and SEB High School, though they might fall outside of the district. This is in collaboration with all of the schools under BCS.

The educators believe that there will be great ‘synergistic benefit’ to providing these concentrated resources that will bolster the students' educational experience, as well as encourage the pipeline of BCS students into the jobs that are opening up.

AJIN Georgia, Hanon Systems and SECO Ecoplastic are working closely with the schools to provide these employment opportunities for students in the future, and Gilliam, Barnwell, Lindsay, and Thompson highlighted the generosity of Mr. Jungho Sea (CEO of AJIN Georgia) and the emphasis he has placed on being a part of helping students receive quality education.

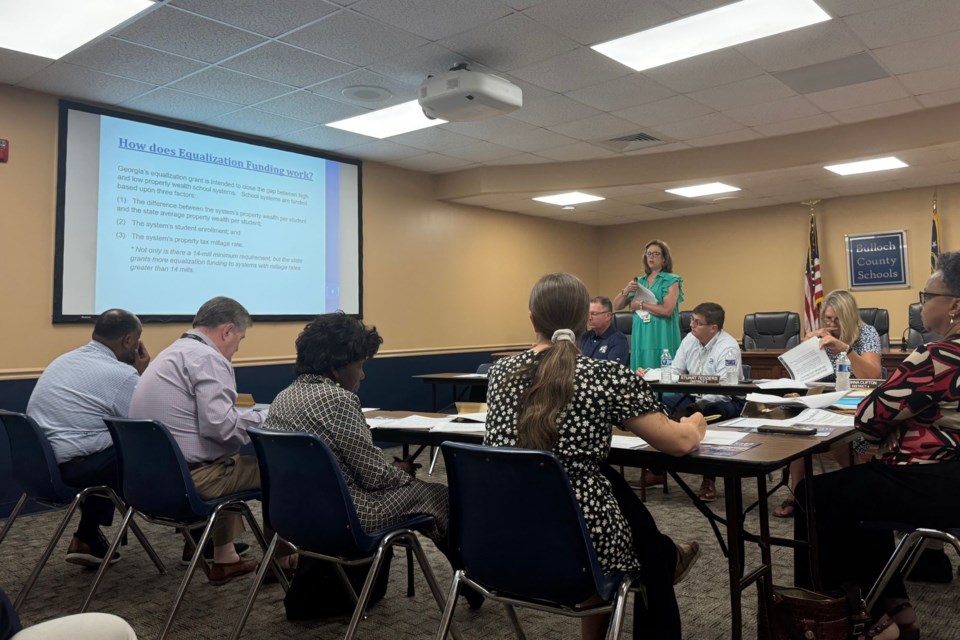

2. Review 2024 Tax Digest and M&O Millage Rate for FY25

Chief Financial Officer Allison Boatright made a presentation explaining the review of the 2024 tax digest and the proposed millage rate for FY25. The millage rate is the number of dollars of tax assessed for each $1,000 of property value. The BCS proposed rate of 7.932 mills means that $7.932 in tax is levied on every $1,000 in assessed value.

Click here to view Millage Rate presentation.

Click here to view Millage Rate memo

Click here to view 2024 Tax Digest and 5yr history of levy

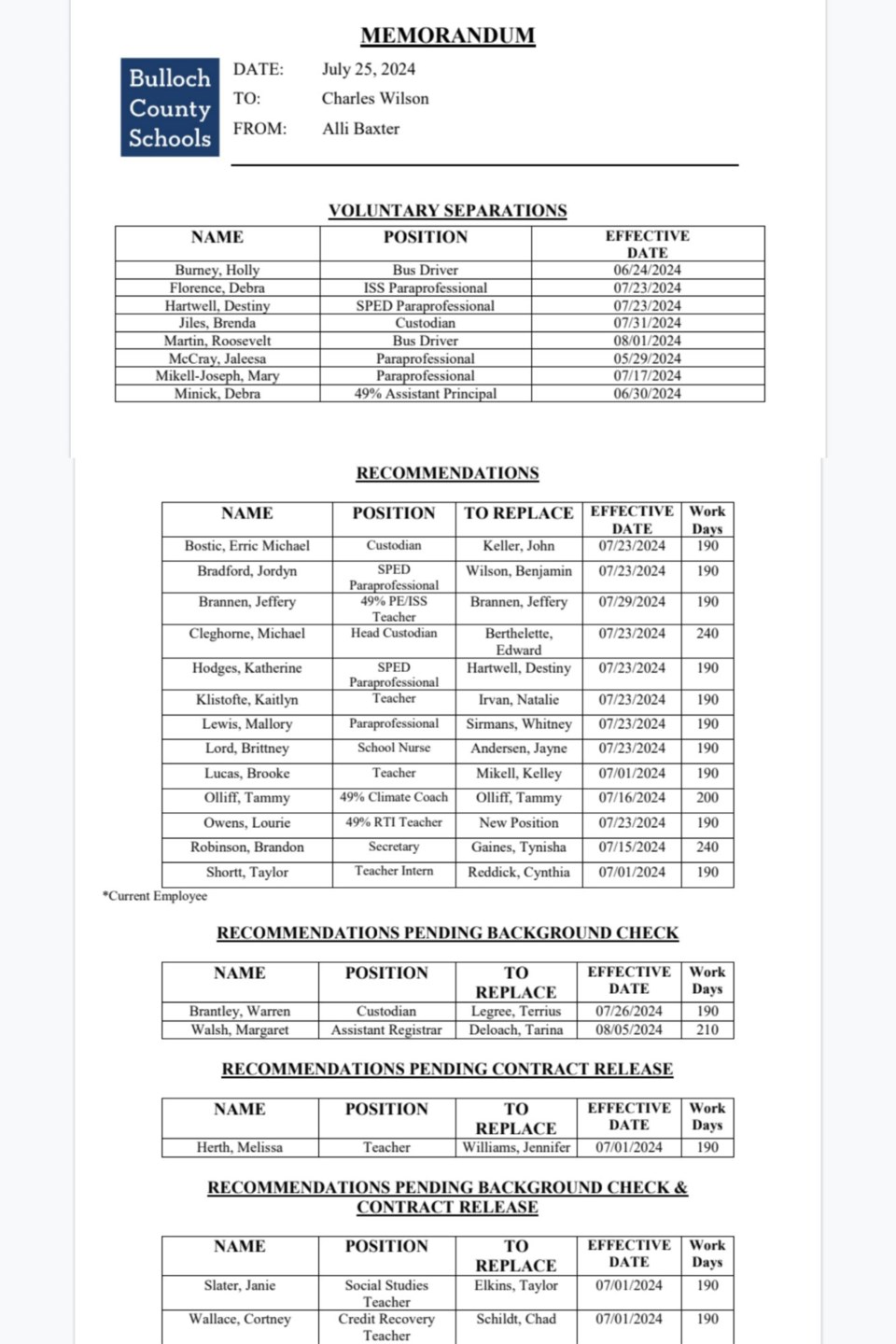

A memo from CFO Boatright to Superintendent Charles Wilson included the following information:

In an effort to maintain a 14-mill requirement in accordance with Georgia Code 20-2-165 and not to jeopardize our state equalization funds of approximately $9.8 million, we are recommending that the Board tentatively approve an M & O millage of 7.932 mills. The proposed 7.932 mills represents a decrease in the M & O millage rate of .546 mills from the current 8.478 mills.

Even though the proposed millage rate is a decrease of .546 mills, the proposed millage rate of 7.932 mills exceeds the rollback millage rate of 7.558 (as received on the PT 32.1 form from the Bulloch County Tax Assessor's Office). Per O.C.G.A. § 48-5-32.1(c) (2), a tax increase must be advertised when the proposed millage rate exceeds the rollback millage rate.

Georgia’s equalization grant is intended to close the gap between high and low property wealth school systems.

School systems are funded based upon three factors:

(1) The difference between the system’s property wealth per student and the state average property wealth per student;

(2) The system’s student enrollment; and

(3) The system’s property tax millage rate.

If BCS does not maintain the required minimum equivalent millage rate of 14 mills, future Equalization Funding of $7.4 million could be at risk. Bulloch county is able to propose the millage rate less than 14 mills because BCS is allowed to offset property tax millage with local option sales tax, for which the sum of both the 6.068 mills in local option sales tax and the 7.932 mill property tax millage rate equals 14 mills.

The following examples were provided to show the school property tax for the average value of property in Bulloch County:

Example #1 (Homestead Property):

- School tax calculation on an average homestead property at 7.932 mills:

- Average Homestead Property Value = $250,000

- Assessed value (40% of the $250,000) = $100,000

- Subtract $2000 Homestead Exemption from Assessed Value = $98,000

- Divide by $1000 ($98,000/$1000) = $98 tax/mill

- Multiply $ tax/mill by the millage rate = $98 * 7.932 mills

- Equals school tax on property of $777.34

Example #2 (Non-Homestead Property):

- School tax calculation on an average non-homestead property at 7.932 mills:

- Average Non-Homestead Property Value = $250,000

- Assessed value (40% of the $250,000) = $100,000

- Divide by $1000 ($100,000/$1000) = $100 tax/mill

- Multiply $ tax/mill by the millage rate = $100 * 7.932 mills

- Equals school tax on property of $793.20

3. SEB water and sewer update

Superintendent Wilson led a short discussion about the approaching deadline for BCS to come to a decision regarding the sewage system for the incoming SEB school.

The first option is to dig a well and build a septic system, which would allow the school to maintain its water operations outside of the Brooklet/Statesboro sewage agreement. Wilson cited potential costs of $6 million for on-site water and sewer and the necessity of 15-30 acres for a septic field, plus ongoing costs and the eventual replacement of the field.

The other option is to strike an intergovernmental agreement with Brooklet to move forward with the sewer agreement as it connects with Statesboro.

Wilson says the decision needs to be made before September, if the school is to be on the sewage system, as this will make it necessary to lay 12 inch pipe rather than 10 inch pipe to carry the sewage from Brooklet to Statesboro. As costs have not been clarified for either the septic system or the connected sewage system, the board has yet to make a decision.

V. New Business for Approval

APPROVED 1. Tentative Adoption of 2024 Tax Digest and M&O Millage Rate for FY25

A notice of the tax increase will be published by the BCS and three hearings will be held on:

- Thursday, August 8, 2024 at 9:00 am

- Thursday, August 15, 2024 at 11:30 am

- Thursday, August 15, 2024 at 6:00 pm

The board entered into executive session, then returned to approve the personnel recommendations for July 25, 2024, then adjourned the meeting.