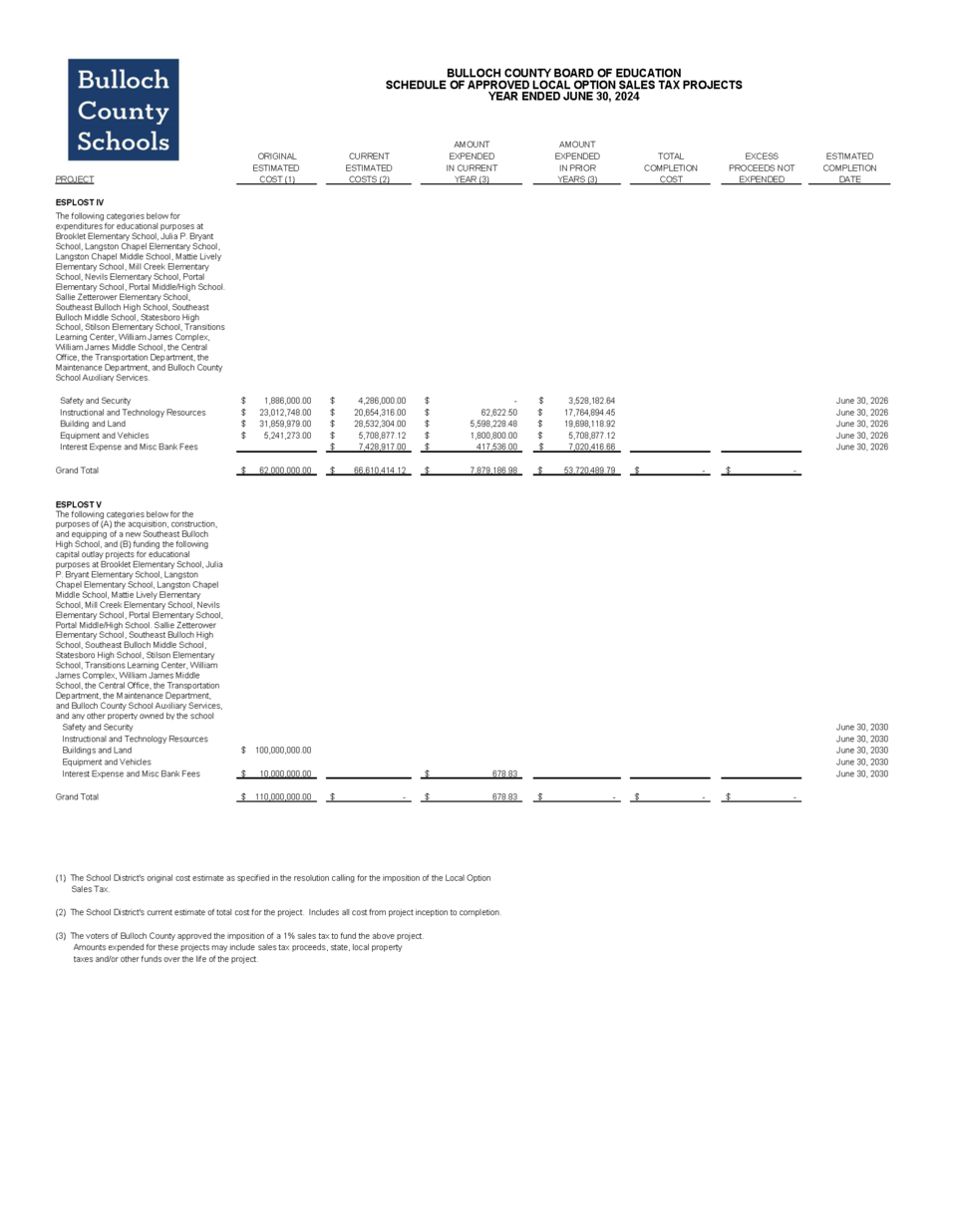

The Bulloch County Board of Education has released its schedule of approved special purpose local option sales tax projects for the year ended June 30, 2024.

The schedule includes a report of expenditures that were made in five different categories for the district's 15 schools: Safety and Security; Instructional and Technology Resources; Building and Land; Equipment and Vehicles; Interest Expense and Miscellaneous Bank Fees. The expenditures are in compliance with the fourth and fifth education special purpose local options sales tax (SPLOST) referendums which were approved by Bulloch County voters on Nov. 7, 2017 and Nov. 8, 2022.

The Special Purpose Local Option Sales Tax is a referendum voted on by Bulloch County voters in which one percent is added to the local sales tax for the purpose of funding building and renovation projects that would otherwise require financing through increased property taxes. SPLOST funds are also available through retiring general obligation bond debts incurred with respect only to capital outlay projects and to issue new general obligation bonds for specific capital outlay projects.

As required by the Official Code of Georgia §50-6-32, this most recent schedule will be posted in Bulloch County's legal organ, The Statesboro Herald, on Thursday, December 5.

It, as well as an archive of previous years' schedules, is also posted to the school district's searchable website, under the Business Services tab, in the Finance Department section, and in the Audit Reports list.

It, as well as an archive of previous years' schedules, is also posted to the school district's searchable website, under the Business Services tab, in the Finance Department section, and in the Audit Reports list.