Just before the board approved the millage rate at their work session on Tuesday evening, August 22, 2024, they were presented with a number of scenarios about the impacts of Georgia HB581 and supporting resolution Georgia HR 1022 that are set to appear on the ballot this November, as well as options for local exemptions that have been a topic of discussion at recent board meetings, with members of the public appearing before the board asking them to consider such action.

The board approved the allocation of a federal grant for the CTAE program as well as a contract for the construction management-at-risk services for Pope Construction Company, Inc, for the replacement of the Mattie Lively Elementary School HVAC System.

Continue reading for more details about the impact of the new millage rate on tax rates and options that board has to consider for local exemptions.

Chairwoman Elizabeth Williams opened the meeting with a moment of silence and the Pledge of Allegiance, before the board adopted the agenda as written.

IV. Work Session

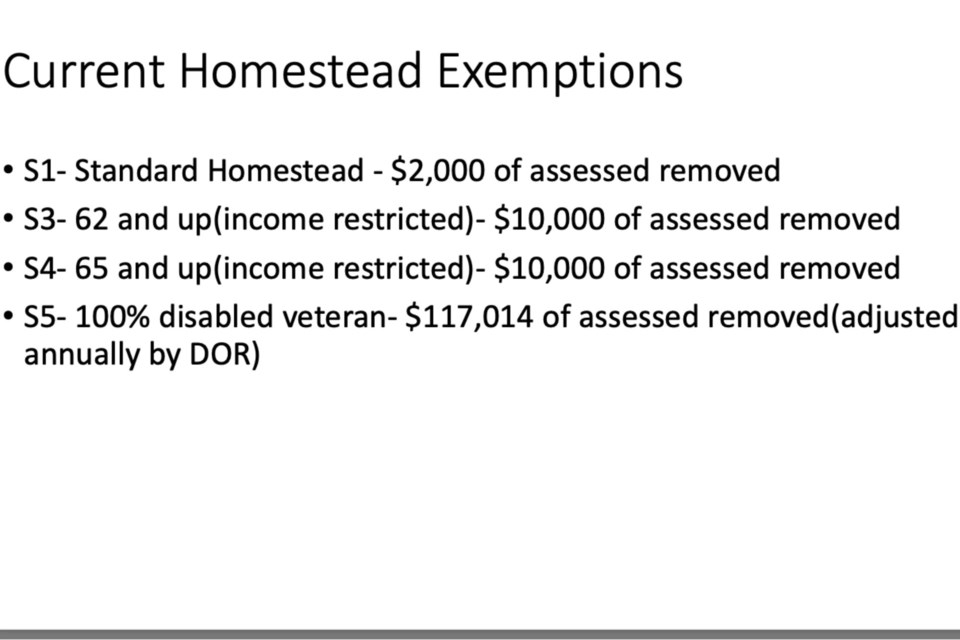

1. Property Tax Exemptions

Robert Fisher, Bulloch County Deputy Chief Appraiser, GCA, AAS, was invited to present information to the board regarding the potential impacts of Georgia HB581 and the supporting resolution Georgia HR 1022 that will appear on the November, 2024 ballot.

Essentially, voters will be asked if they want to limit increases in the assessed value of homesteads through a floating homestead exemption. Fisher clarified that a property would still maintain its appropriate fair market value but would be protected from inflationary gains for tax purposes. The bill would go into effect in addition to current homestead exemptions

Fisher noted that if the board does not vote to opt out of the exemption, inaction will result in the implementation of the tax exemption. If they intend to opt out, they will need to make a public notice and hold three public meetings.

Fisher said that HB581 would likely reduce the amount of inflationary growth in the residential portion of the digest. If the bill was in place for tax year 24, $234,435,693 of fair market value would have been removed from the digest. At the millage rate of 7.932, the school board will lose $743,817 in tax revenue.

“We have a pretty good feeling that both of these are going to pass,” said Fisher

Each taxing jurisdiction within the county will decide individually if they want to opt out or not. The county and the cities have the option to implement a flexible local option sales tax to recoup the lost revenue, but the school board does not because they already have a local option in effect.

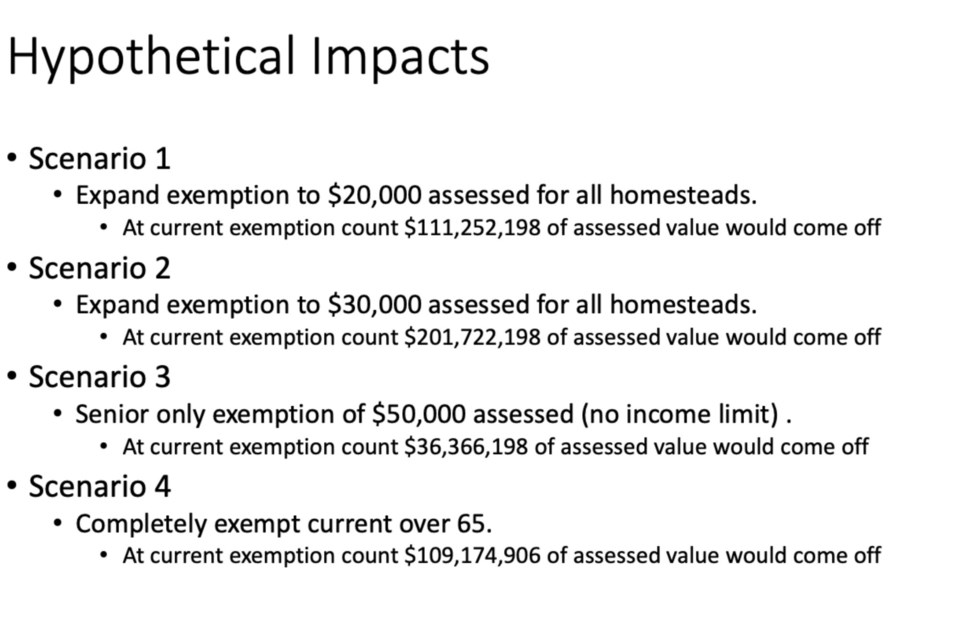

At the prompting of public requests for local exemptions, such as senior school tax exemptions, Fisher presented a number of scenarios, still advising the board that taxpayers would not see any effects until 2026 tax bills. This is important because if made effective, the first few years of HB581 homestead tax exemption could provide menial tax relief, but as market rate increases and tax payers are exempt for increased taxes, revenue disparity could be exacerbated.

Fisher says that in scenario 3 and 4 (below), he estimates that the number of exemptions would “conservatively triple” if the bills passed, because taxpayers would actually sign up after learning about it. He projects about 2,500 exemptions vs typical 1,000 per year if HB581 is passed

“I think we all need to think through this very thoroughly…as a board what we need to support,” said board member Stewart Tedders. He said that there are two ways to look at this: from the position of a board member and that of homeowners. He asked Fisher to clarify if the exemption would reduce resources for schools.

Fisher said this is not a direct impact but would reflect on what the millage rate needs to be set at, and the school board is obligated to set millage rate that funds budget.

Superintendent Charles Wilson furthered that it would shift the tax burden to meet the needs of tax collection.

Below is a summary of Fisher's presentation. CLICK HERE to view the full presentation.

Summary of the presentation on Georgia Property Tax Legislation Update: HB 581 and HR 1022

Georgia lawmakers have introduced significant property tax reforms through HB 581 and HR 1022, with changes aimed at protecting homeowners from rapid market value increases and enhancing transparency in tax assessments.

Key Provisions:

1. Floating Homestead Exemption:

- Protects homeowners against market rate increases, including those influenced by neighboring home values.

- The base year value of a homestead may increase annually by an inflationary rate determined by the State Revenue Commissioner.

- This exemption adds to existing homestead exemptions without replacing them. However, local governments may opt out by following specific procedures by March 1, 2025.

2. New Requirements for Property Tax Bills:

- Tax bills must now include a notice if the millage rate adopted by a tax authority exceeds the estimated roll-back rate, warning homeowners of a potential tax increase.

3. Revised Notice of Assessment:

- Removes confusing tax estimates and replaces them with an estimated rollback rate for each taxing jurisdiction.

4. Ballot Question:

- A constitutional amendment question will be presented to voters, asking if the state should allow a floating homestead exemption that limits increases in assessed home values, with an opt-out provision for local governments.

5. HB 808 – Personal Property Tax Exemption Increase:

- Proposes raising the personal property tax exemption threshold from $7,500 to $20,000, pending voter approval on the November ballot, with an effective date of January 1, 2025.

Impacts on Tax Digest:

- HB 581: Would have removed $234 million of fair market value from the digest for the 2024 tax year, resulting in a potential loss of $743,817 in tax revenue.

- HB 808: If enacted, this would lead to a loss of $4.5 million in assessed value, necessitating an increase in the millage rate to maintain current revenue levels.

Creation of Local Homestead Exemptions:

- Local governments can offer additional exemptions by passing a resolution, which then requires approval through a constitutional referendum by county voters.

Implications for Homeowners:

- The proposed legislation aims to provide greater financial stability for homeowners by capping increases in assessed property values and ensuring more transparent tax billing. However, the loss in revenue may result in higher millage rates to compensate for the reduced tax base.

This legislative package will be closely watched as it progresses through the General Assembly and potentially onto the November ballot for voter approval.

V. Public Participation - No Public

VI. New Business for Approval

APPROVED 1. Adoption of 2024 Tax Digest and M&O Millage Rate for FY25

In the document below you will find a copy of the 2024 Tax Digest and 5-Year History of Levy for the Bulloch County Board of Education's M&O millage rate for FY '25 reflecting the proposed millage rate of 7.932 mills.

The Board adopted the M & O millage rate of 7.932 mills.

CLICK HERE for full presentation

Summary of the Millage Rate Presentation

How the Millage Rate Works:

- The millage rate represents the amount of tax assessed for every $1,000 of a property's value.

- The approved rate for Bulloch County Schools (BCS) is 7.932 mills, meaning $7.932 in tax is levied for every $1,000 of assessed property value.

Example Calculations:

- Homestead Property: For a $250,000 home, the assessed value after exemptions is $98,000, leading to a school tax of $777.34 at the 7.932 millage rate.

- Non-Homestead Property: For a $250,000 property, the school tax would be $793.20.

Millage Rate History:

- The proposed 7.932 mills for FY 2025 is a partial rollback from the previous year’s 8.478 mills.

- Over the past decade, the millage rate has seen various rollbacks and changes, generally trending downward from 9.848 mills in FY 2015.

Why No Full Rollback This Year:

- Georgia law requires school systems to maintain a minimum equivalent millage rate of 14 mills to avoid losing Equalization Funding, critical for low-property wealth districts like BCS.

- BCS uses Local Option Sales Tax (LOST) revenue to offset this millage requirement, allowing them to propose a rate of 7.932 mills instead of 14 mills.

Impact on Taxpayers:

- The proposed rate is a slight increase over the rollback rate, resulting in an approximate $36.65 increase in school taxes for a homestead property valued at $250,000, and $37.40 for a non-homestead property.

- Despite this, the proposed 7.932 mills rate is lower than the current 8.478 mills, reducing taxes by $53.50 and $54.60 for homestead and non-homestead properties, respectively.

Public Hearing and Notice:

- The Bulloch County Board of Education has tentatively adopted this millage rate, requiring a 4.95% increase in property taxes.

- Public hearings are scheduled to allow community input on this proposed tax increase.

This presentation aims to explain how the millage rate affects taxpayers, why BCS is not rolling back the millage rate further, and how equalization funding impacts the school system’s financial strategy.

APPROVED 2. CTAE/Perkins Allocation Approval

Bulloch County Schools received a $167,438 Federal Perkins Plan Grant for the 2024-2025 school year. The funds will be used to improve career education and student academic and technical performance. The grant will be used to purchase supplies, textbooks, software, equipment, and to cover the costs of professional development, student competitions, and field trips.The school district also received $329,000 in state-funded CTAE grants, which will be used to purchase a CAT simulator for the Heavy Equipment Operation Program at Southeast Bulloch High School and to renew industry certification for the Allied Health Program at the same school.

Click here to view the full Perkins Grant presentation

APPROVED 3. Mattie Lively HVAC CM at Risk Approval

"After a thorough review of the responses to our request for proposals and interview process with two construction companies, we are recommending that Bulloch County Schools select Pope Construction Company, Inc. for Construction Management-at-Risk Services for the replacement of the Mattie Lively Elementary School HVAC System. Their Construction Fee is 8% of the total project cost, which will later be determined after design completion by a Guaranteed Maximum Price," Brad Boykin, Assistant Superintendent of Business Services.

CLICK HERE to view proposal.

The board entered executive session and returned, to approve the personnel recommendation for August 22, 2024

APPROVED IX. Personnel Recommendations for August 22, 2024