Georgia Southern University’s latest Economic Monitor, which analyzes Q2 2018 data and identifies trends affecting the regional economy, reports that Savannah’s three-county metro economy shows tourism growth leading the way, while retail sales, port activity and overall employment also contributed to area growth.

“Continued strength in the labor market lifted the index while the housing market mostly moved sideways during the quarter,” stated Michael Toma, Ph.D., Fuller E. Callaway Professor of Economics and director of the Center for Business Analytics and Economic Research (CBAER). “Overall, expansion in the regional economy continued at an above-average pace. However, expect slowing growth through the remainder of 2018.”

During the second quarter of 2018, the Savannah metro economy expanded at a rate of 1 percent, or 3.9 percent annualized. Approximately half of the lift in the index was provided by the tourism sector, a notable rebound from weather-related declines of about 3 percent in the winter quarter. Retail sales increased 6 percent, and port activity maintained year-over-year growth of 6.3 percent. Electricity sales remained flat, and consumer confidence in the south Atlantic states declined 4 percent, erasing the improvement in consumer sentiment during the first quarter.

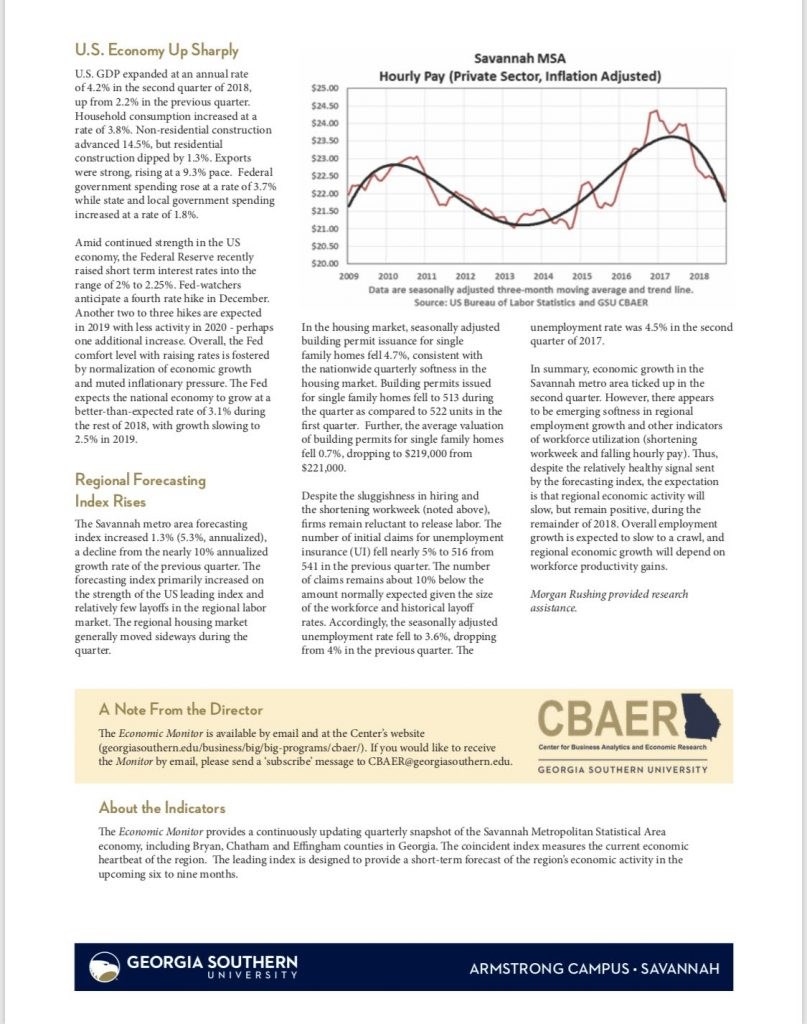

Overall, area economic growth increased slightly in the second quarter, however, there is emerging softness in regional employment growth as well as other indicators of workforce utilization, including shortening workweeks and falling hourly pay. Throughout the rest of the year, the expectation is that regional economic activity will slow but remain positive.

Highlights from the latest Economic Monitor include:

TOURISM

Tourism contributed largely to the lift in the Savannah Metro Business Index during the second quarter. Seasonal and inflation-adjusted hotel room rentals increased 8.2 percent, while airport traffic increased 11 percent.

EMPLOYMENT TRENDS

Total employment reported in Savannah’s metro area was 179,800, up slightly less than 1 percent as compared to year-ago data. This extends the period of slowing employment growth dating back to 2015. Early data from the third quarter suggests continued sluggishness in employment growth.

Manufacturing is at a three-year high, adding 200 workers to stand at 17,700. Construction employment remained steady at 7,500, and local government employment fell by 300 workers. The leisure and hospitality industry employs 26,000 workers.

REGIONAL UNEMPLOYMENT

Regional employment increased by 900 jobs during the quarter; however, the data reported for the individual sectors of the economy, when taken together, suggests a loss in employment of about the same magnitude. The total and sector-level data have been generally moving together but trends in individual sectors have become more difficult to identify in quarter-to-quarter data.

Initial claims for unemployment insurance fell nearly 5 percent from the previous quarter. The number of claims remains about 10 percent below the amount normally expected given the size of the workforce and historical layoff rates. The seasonally adjusted unemployment rate fell from 4 percent in the previous quarter to 3.6 percent this quarter.

RESIDENTIAL CONSTRUCTION

Seasonally adjusted building permit issuance for single-family homes fell 4.7 percent, consistent with the nationwide quarterly softness in the housing market.

Building permits issued for single-family homes fell from 522 in the first quarter to 513 in the second quarter. The average valuation of building permits for single-family homes dropped 0.7 percent, from $221,000 to $219,000.

ECONOMIC INDEX/FORECASTING INDEX

The forecasting index increased 1.3 percent, or 5.3 percent, annualized, which represents a decline from the nearly 10 percent annualized growth rate of the previous quarter. The forecasting index increased on the strength of the U.S. leading index and relatively few layoffs in the regional labor market.

The Economic Monitor presents quarterly economic trends and short-term economic forecasts for Savannah’s Metropolitan Statistical Area (MSA). The quarterly report measures the heartbeat of the local economy, based on the analysis of economic data from the U.S. Census Bureau, the U.S. Department of Labor’s Bureau of Labor Statistics, the City of Savannah, Georgia Power and the three counties in the MSA — Chatham, Bryan and Effingham.

The report is available for free by email. To subscribe, email [email protected].

CBAER, a part of the Business Innovation Group in Georgia Southern’s Parker College of Business, meets the applied research needs of Savannah’s business and community organizations. Areas of concentrated research include regional economic forecasting, economic impact analysis, economic development and business expansion, tourism development, survey-based research and specialty reports on topics of state, regional and local interest.